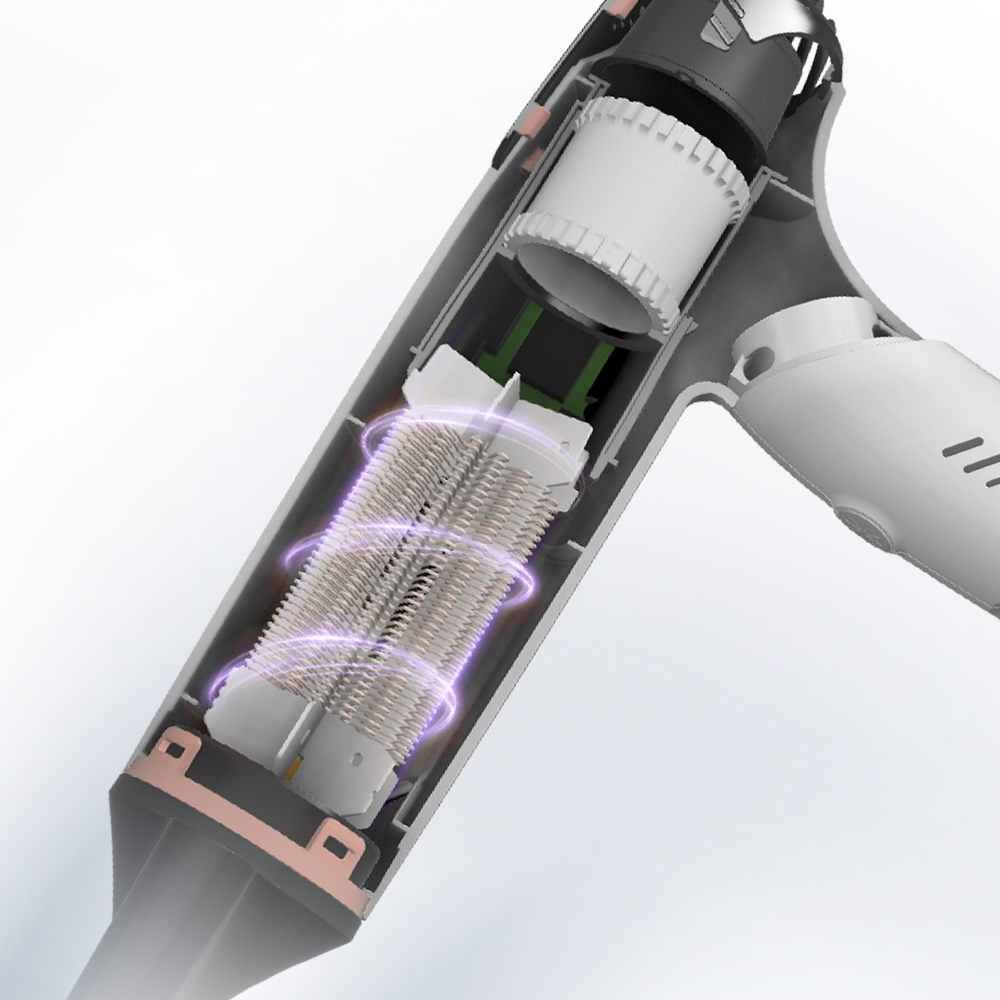

Patented Technologies

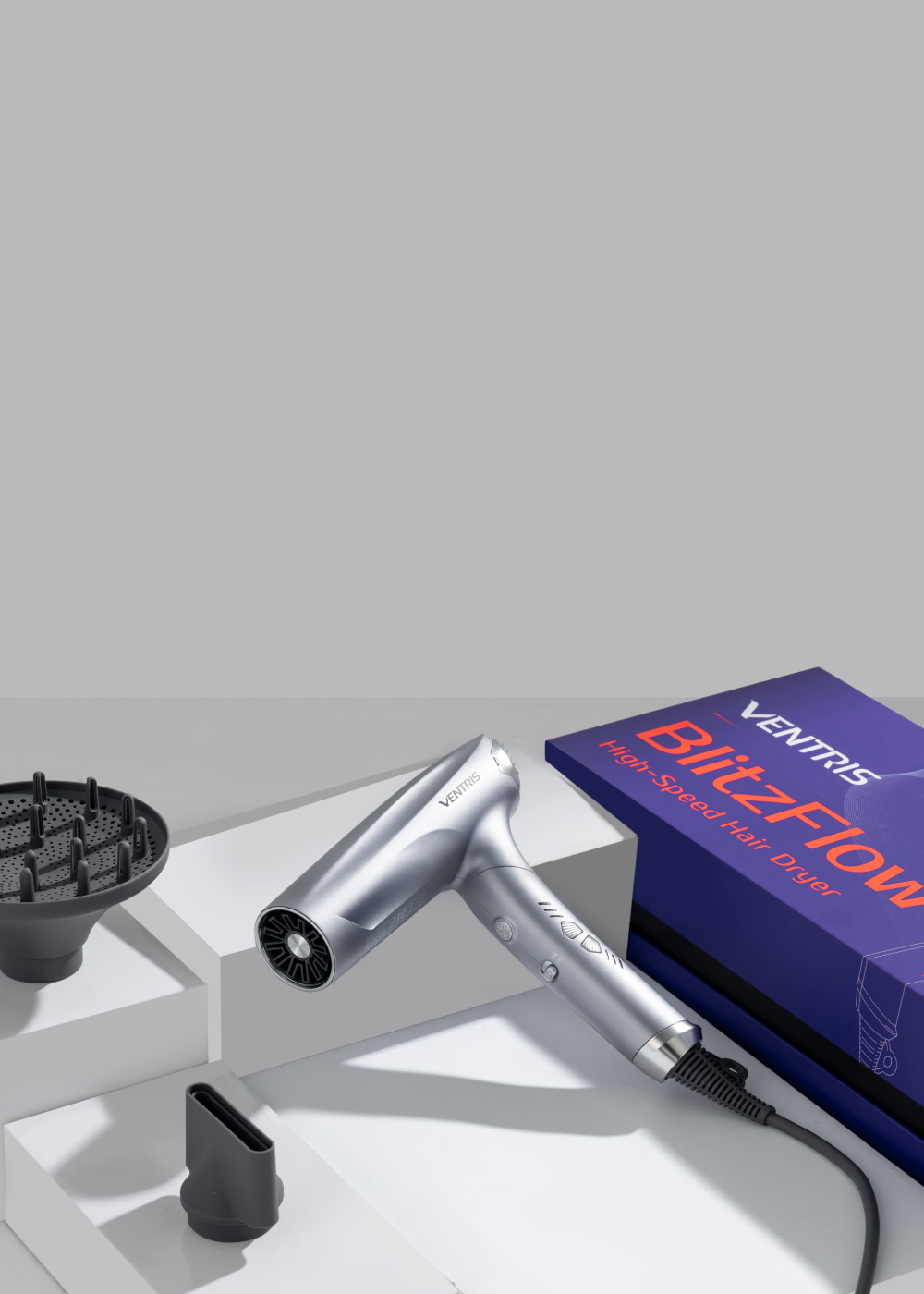

Salon-Grade Hair Care Anywhere

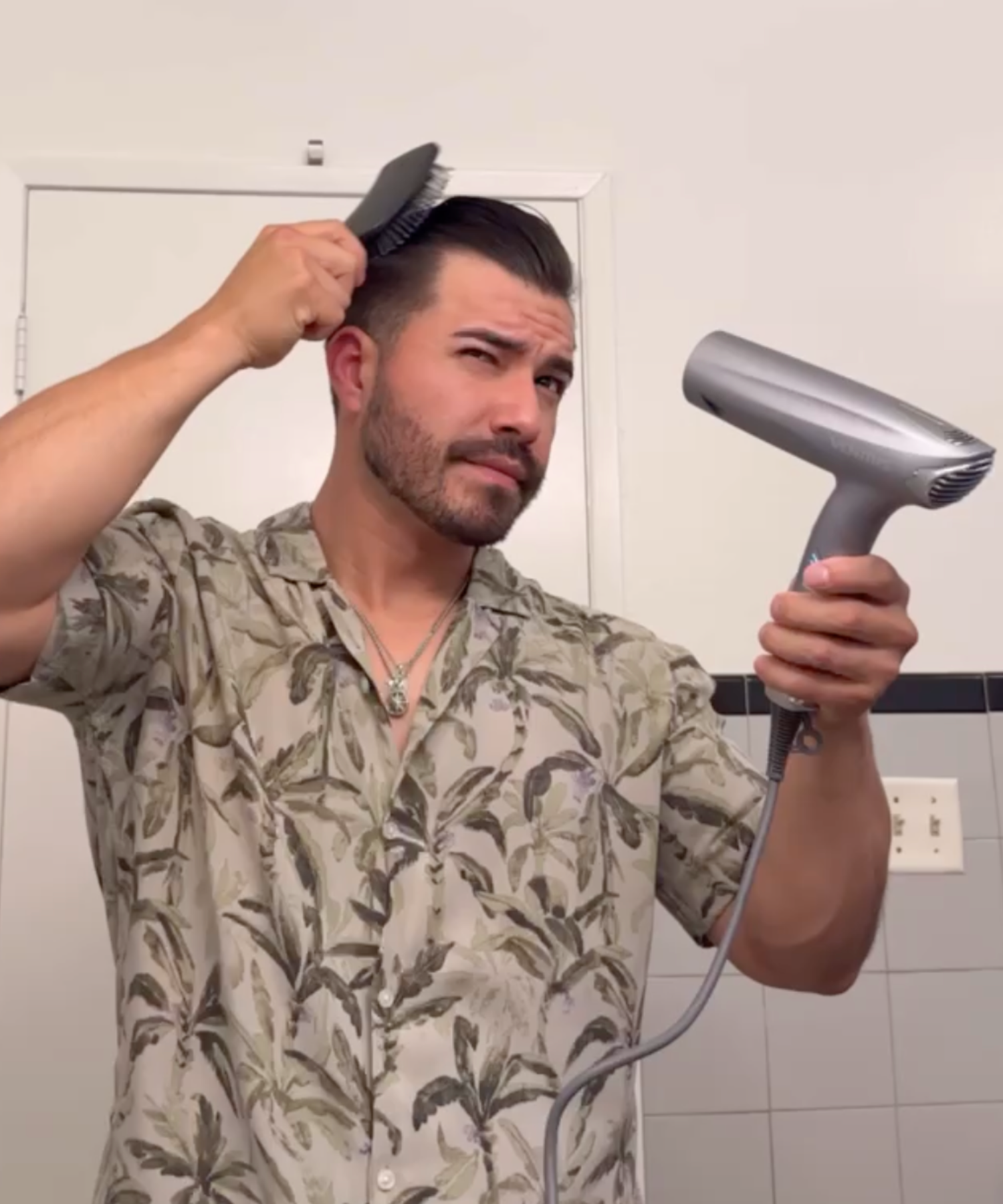

Fans Favorite

Beloved By Many

Don't Just Take Our Word For It

Hear what others are saying about VENTRIS

Let customers speak for us

Amazon Customer

5-Star Reviews

Fantastic hair dryer!

The hair dryer is powerful and very quiet. Airflow and heat respond very quickly to control changes. -- John

Hair Dryer PLUS

This hair dryer is what you'd expect in a high end dryer. It does a nice job in drying your hair. BUT, it goes far beyond that. -- TIG

Sturdy & Practical

I like everything about this compact hair dryer. It’s very quiet, has good air flow and variable temp settings. -- Ladyfingers

Game Changer

I absolutely hate wasting my time drying my hair, but this dryer makes it so it isn’t such a chore and so time consuming! -- Tennis1

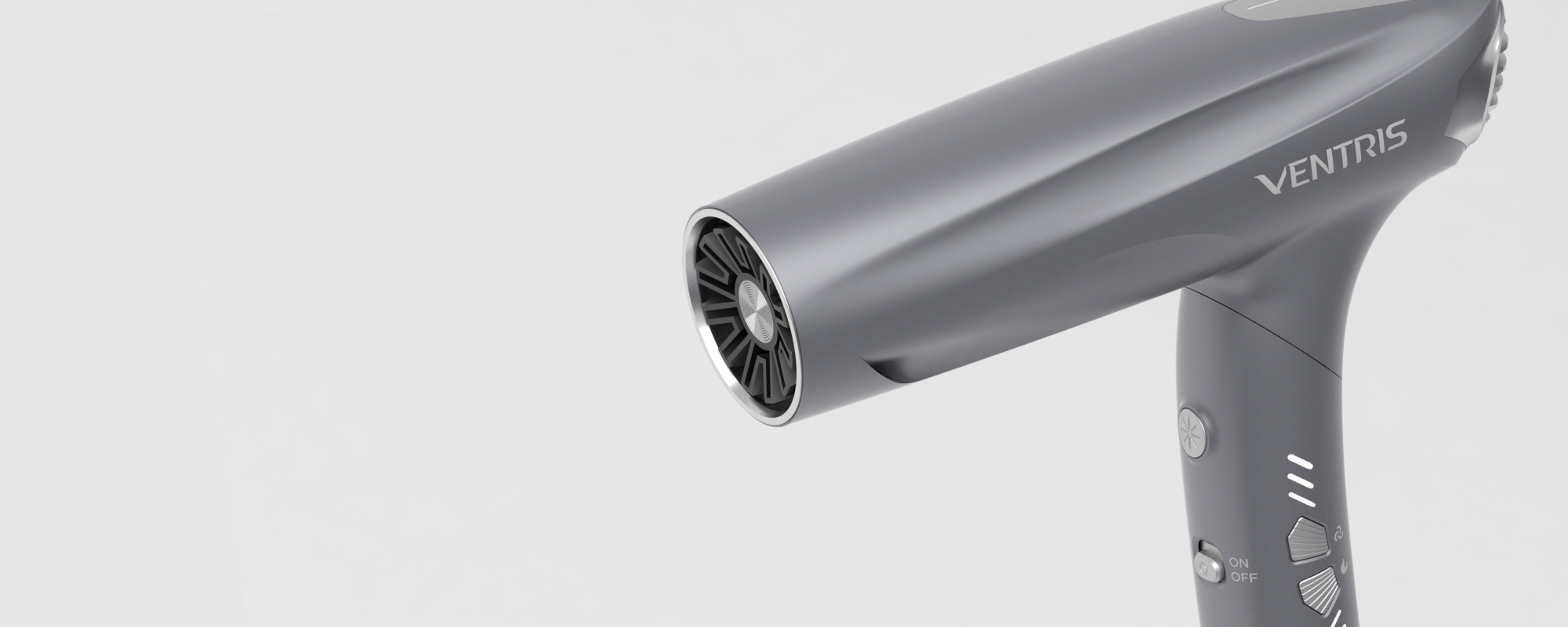

Sleek & Powerful

It's sleek, lightweight, and very powerful. It dries my hair quickly, thanks to its high-wattage motor and multiple heat. -- Sophie

Obsessed with it!

The bag is perfect for carrying the dryer and attachments . My goodness it even cleans itself. I am loving this purchase. -- Momscaboose

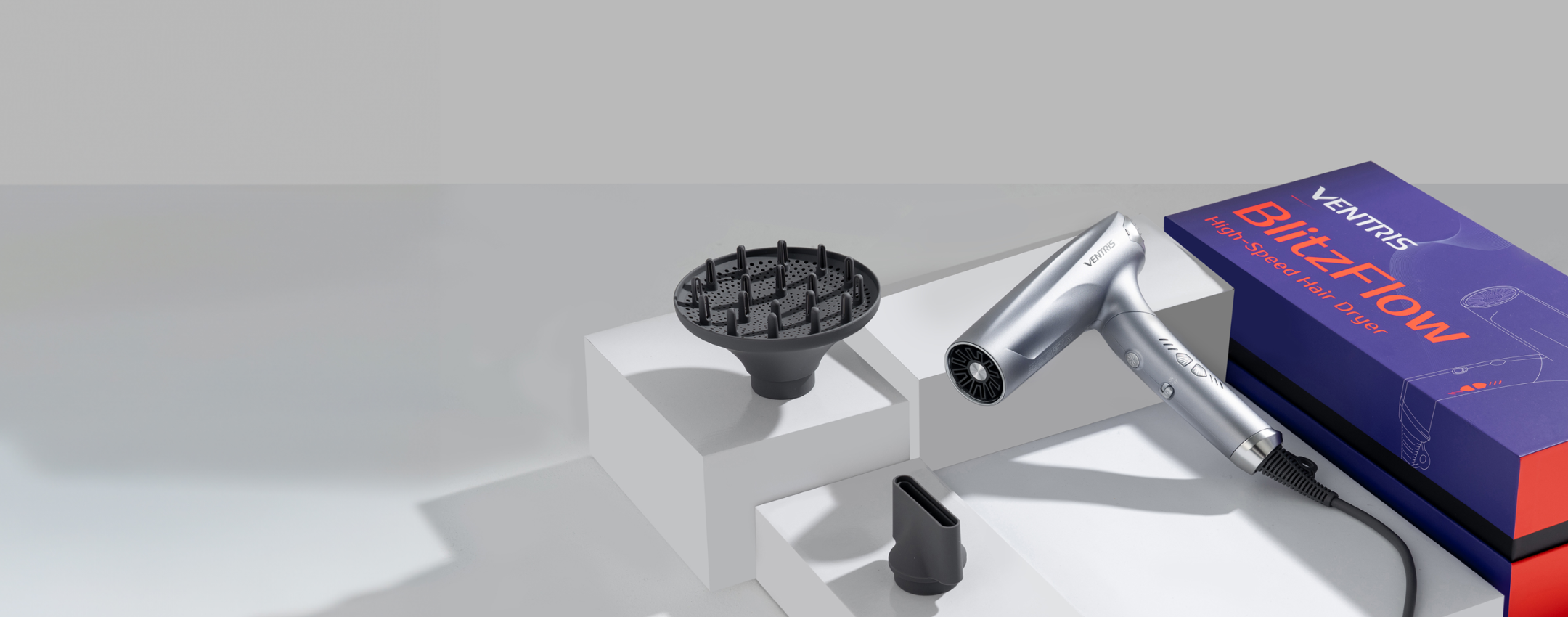

Diffuser

Diffuser

Keeps roots lifted and curls bouncy with dispersed airflow.

Styling Nozzle

Styling Nozzle

Concentrated airflow for targeted drying.

ABOUT VENTRIS

Dare to Explore, Dare to Be

VENTRIS is a tech-driven beauty brand, designed to provide high-performance hair care solutions for damaged hair.

The VENTRIS story begins with an adventure, a dream, and a desire to believe that everyone can create unique value in the world through endless self-exploration.