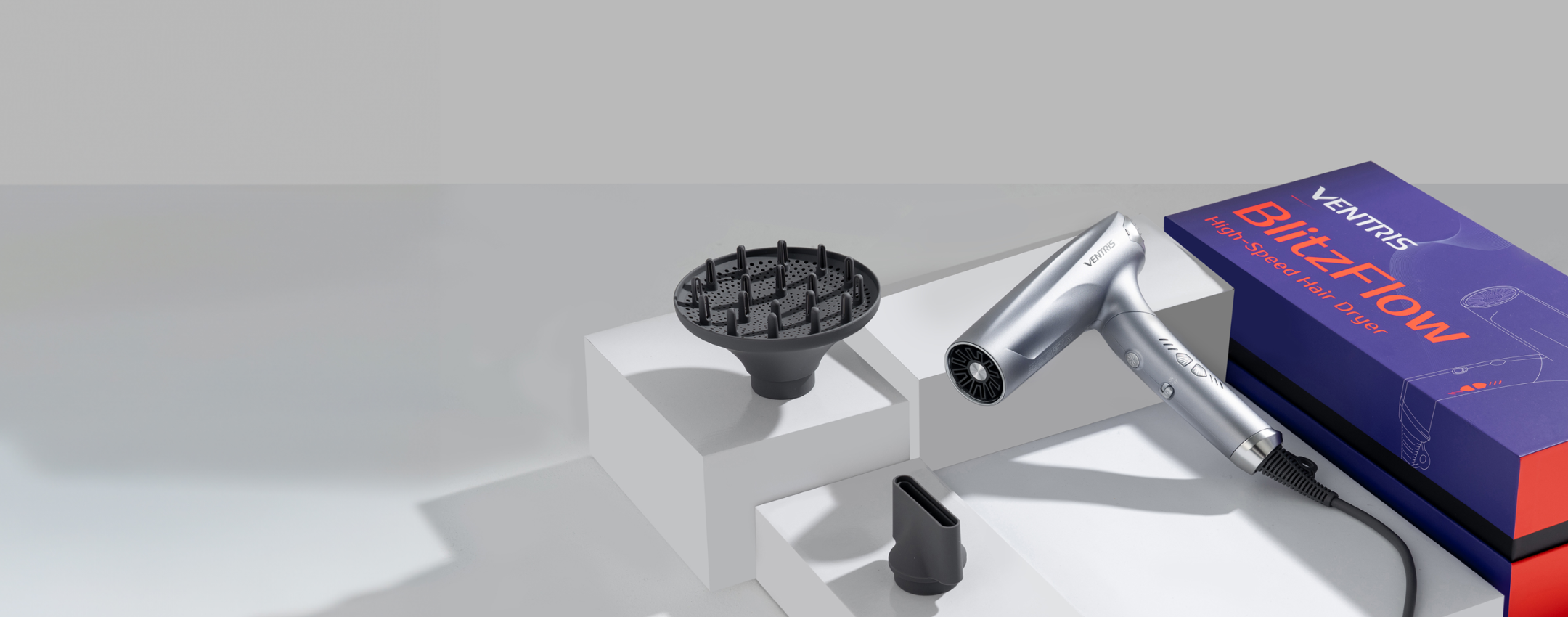

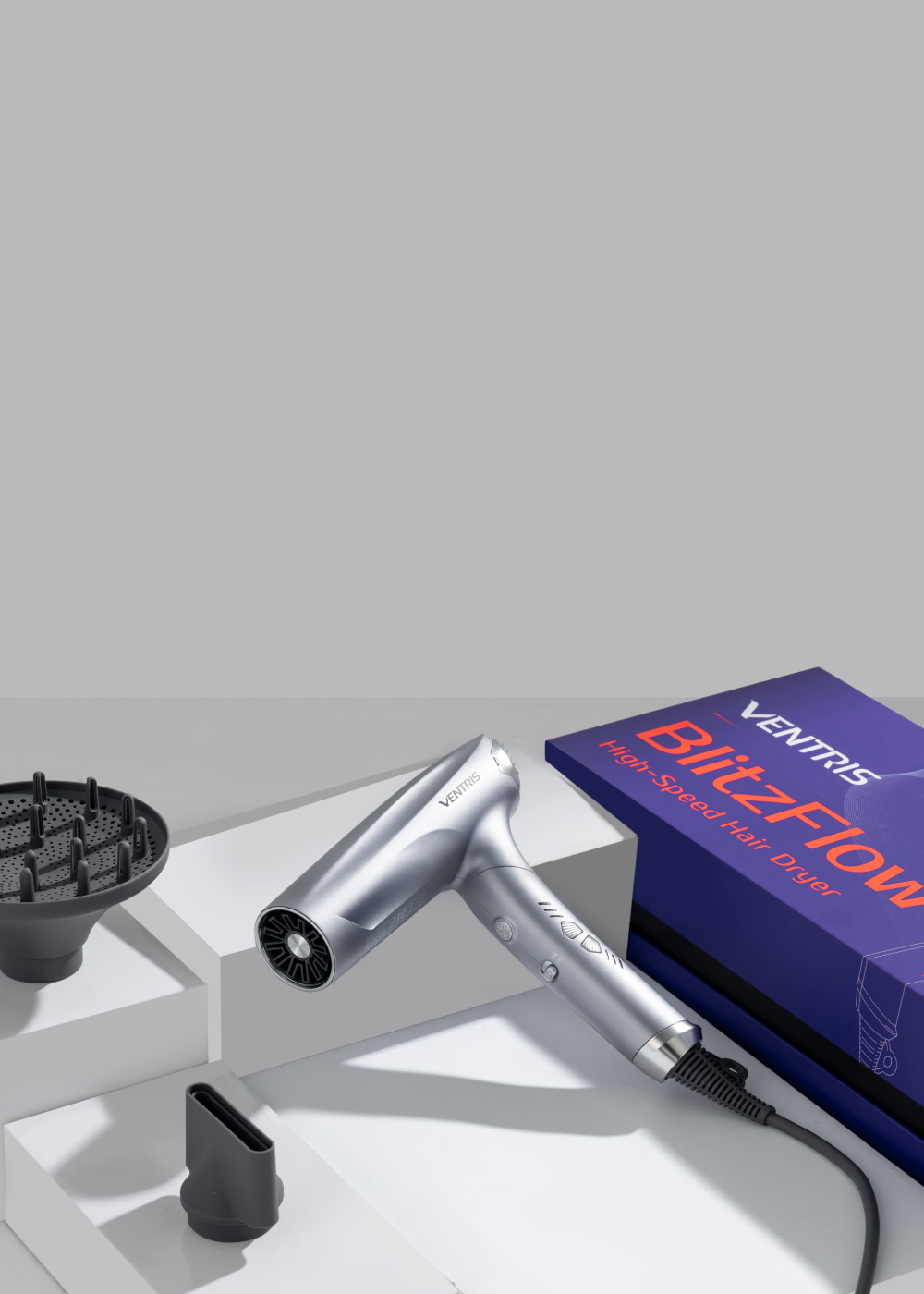

VENTRIS BlitzFlow ™

Premium Hair Dryer Collections

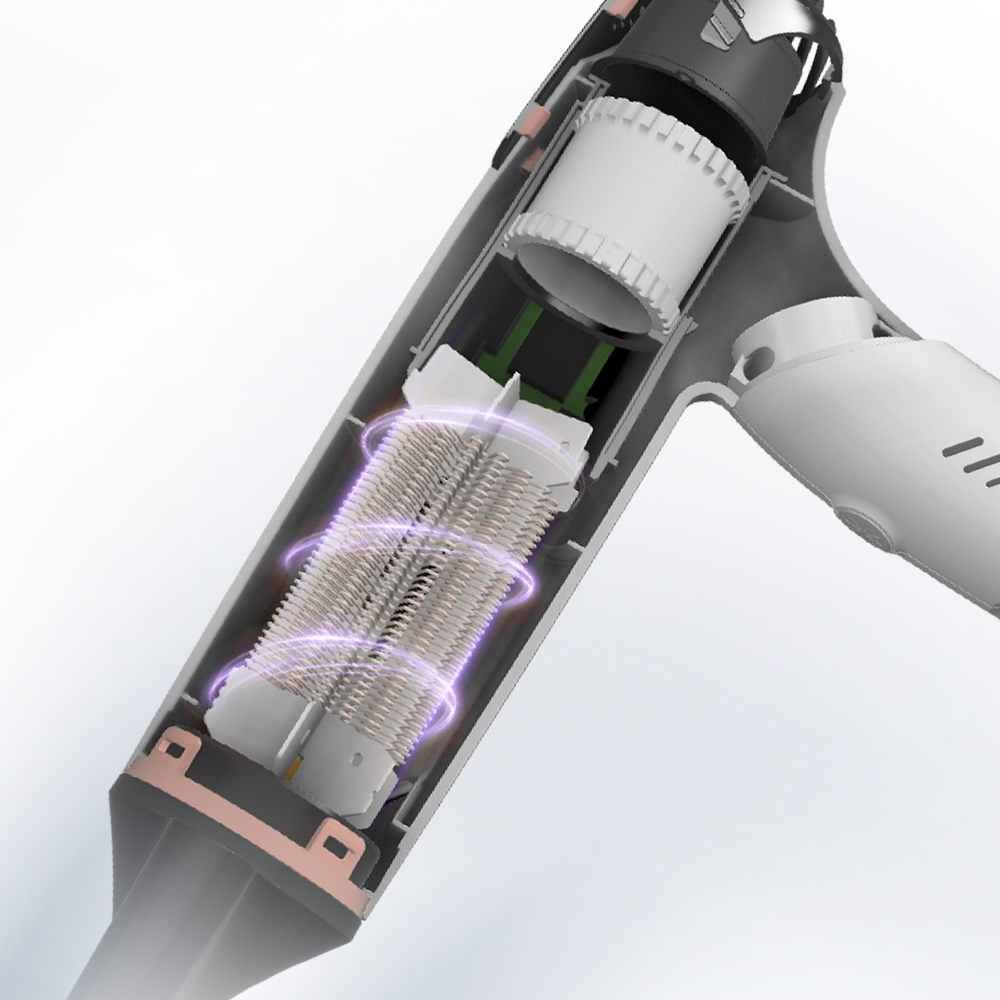

New Patented Technologies

Make Hair-Care Easier

VENTRIS BlitzFlow ™ Premium Hair Dryer

Amazon Customer

5-Star Reviews

Fantastic hair dryer!

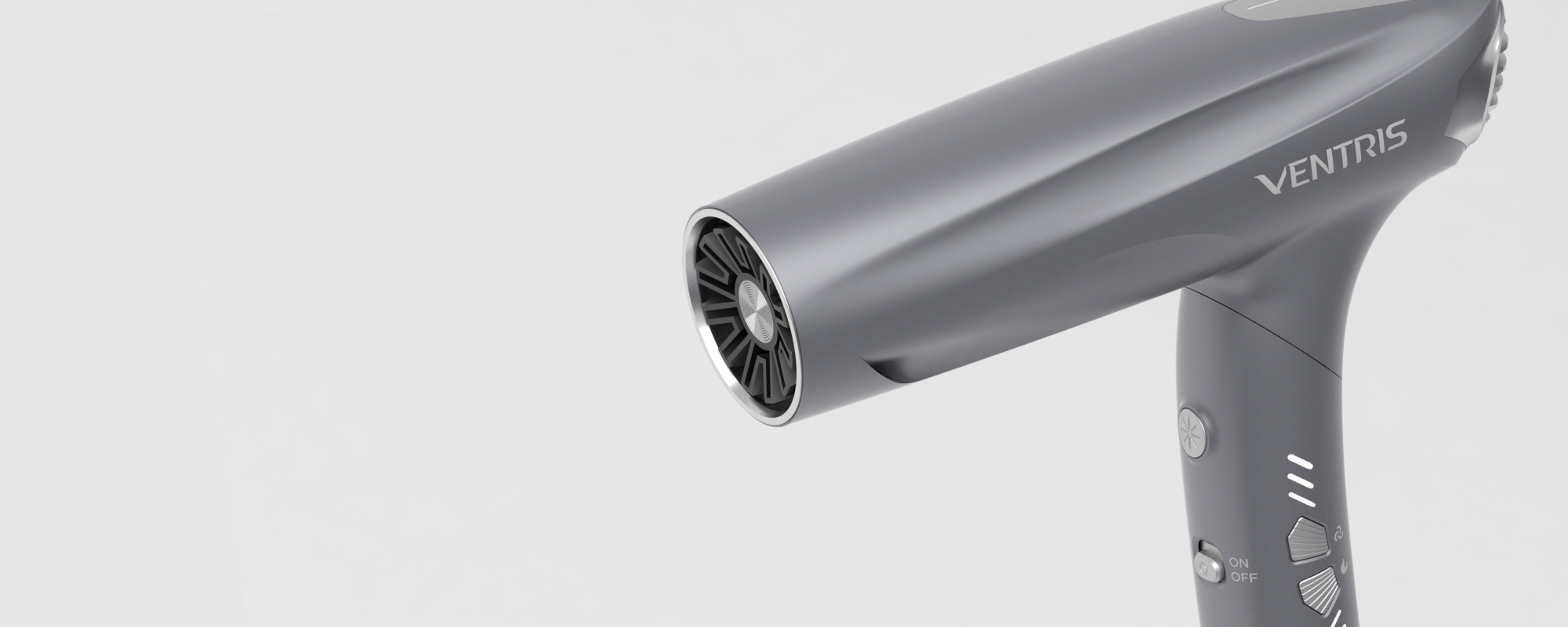

The hair dryer is powerful and very quiet. Airflow and heat respond very quickly to control changes. -- John

Hair Dryer PLUS

This hair dryer is what you'd expect in a high end dryer. It does a nice job in drying your hair. BUT, it goes far beyond that. -- TIG

Sturdy & Practical

I like everything about this compact hair dryer. It’s very quiet, has good air flow and variable temp settings. -- Ladyfingers

Game Changer

I absolutely hate wasting my time drying my hair, but this dryer makes it so it isn’t such a chore and so time consuming! -- Tennis1

ABOUT VENTRIS

Dare to Explore, Dare to Be

The VENTRIS story begins with an adventure, a dream, and a desire to believe that everyone can create unique value in the world through endless self-exploration.

Adventure is an attitude towards life.